Economic Indicator Analysis

Company’s Product and market structure

The Microsoft Corporation is the world’s number 1 software company. Its two most popular products are the Windows operating system and Office software suite. Microsoft Corporation also manufactures gaming consoles – Xbox, CRM supplications – Microsoft Dynamics and digital music players – Zune. Over 50% of all Microsoft Corporation’s sales are made in the U.S. (Hoovers, 2011).

The XBox is a game console developed by the company in an attempt to tap into the lucrative global gaming industry. The Xbox 360 is an updated version of the original Xbox, and is considered to be of the seventh generation gaming consoles. The Xbox 360 was launched in year 2005 and it was received very well by the public as it completely sold out in all major parts of the world. In a fast developing and highly competitive world gaming market, it was crucial for the Xbox to be continuously improved upon. Hence, Microsoft decided in the year 2010 to introduce another not so different version of the Xbox 360 that would be slimmer and with more features than the former. A crucial feature added was the online connectivity option that allows gamers to compete with players across the globe in real time. Games can now directly be bought and downloaded from the internet to the console. In addition, users can access TV shows and music using the new multimedia feature of the XBox (Voets 2010).

Some of the older versions of the Xbox 360 are fading from the market as more people embrace the newer version which has more features like the storage capacity that has been increased and more ports to accommodate other accessories that are compatible with the new version. The rise to fame of the products has not been easy due to stiff competition they have faced from other companies like Sony which is known for its version of a game console referred to as the PlayStation. Another company that has been competing with the Microsoft’s Xbox 360 is the Nintendo Company which is known for the GameCube console that was brought into the market towards the end of the year 2001. Sega Company is also among the top three companies that compete for customers in the gaming industry and it has offered Microsoft Corporation stiff competition from the year 1999, when it was first introduced into the market its product named Dreamcast.

Despite the fact that the launch of the Xbox 360 took place much later after some companies like the Sega had already accessed the market, it made headways in the market arena and ranked up to the second place taking into account the total number of units it had sold. It stayed ahead of other companies like Sega although it could not overtake Sony which had sold much more units. This it did and was made possible by the fact that Microsoft had other products already in the market like software and operating systems. This translated into the company having a solid financial standing which made it possible for the company to enter and penetrate the market that had already been tested and penetrated by its competitors.

The XBox falls under the category of the seventh generation gaming consoles and one factor that made the product penetrate the market so deeply was the introduction of more features that had been added. Their compatibility with older Xbox accessories as well as entertainment systems made it easier for the product to be used and teamed with various electronic brands (Voets 2010). Another feature that has made the product do well in the market is the capability of being compatible with the famous series of Halo and Gears of war. These games have made the Microsoft Corporation make business headways even in times when the economy was not doing well. The games are loved all over the world and this increases the market breadth.

Marketing Structure

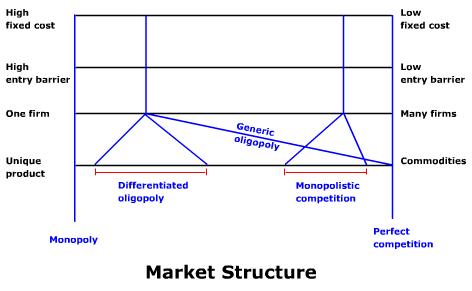

A market structure helps one understand the economic power of firms operating within in. Most importantly, it enables better understanding of the pricing power that firms hold over their own products. For instance, the uniqueness of a product leads o a higher entry barrier. Also, the larger the scale economy, the higher the pricing power of the firm will be. Firms that are based in a perfect competition market and sell homogenous products have barely any pricing power and the market decides the price of their product. On the contrary, firms based in a monopoly that are selling unique, rare or patented products can have near absolute pricing power, a factor that often leads to price discrimination. The markets in between monopoly and perfect competition are volatile, where firms can hold pricing power but need to exercise it with great caution. Figure 1 depicts the various market structures and the pricing power correlation:

Figure 1: Market Structure and Pricing Power

It is important to note that Xbox competes in an Oligopoly market, wherein price based competition seldom yields desired results. The 2007 gaming console price war can be used effectively to highlight this point. According to the BBC (BBC, 2007), the three gaming console giants made the following price alterations to beat competition:

- Microsoft cut the Japanese price of its Xbox 360 games console by 13% as it struggled to match sales of rivals Nintendo Wii & Sony PlayStation 3

- Sony also cut the cost of the PlayStation in the US & introduced a cheaper version. Both the Xbox 360 & PlayStation 3 were trailing behind sales of the Wii

- In the first half of 2007, Microsoft sold 122.565 units of Xbox 360 in Japan, compared with 503, 554 PlayStation 3 units & 1.78 million of the Wii

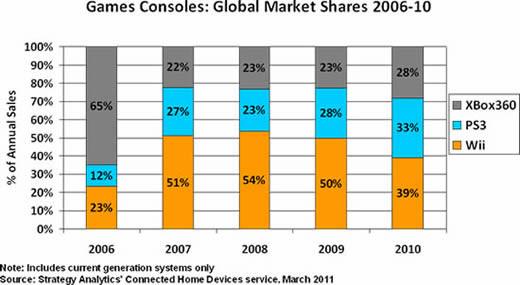

Comparing this data with the data given in Figure 6, it is clear that despite lowering prices of its console, Xbox was not able to regain the market share supremacy it held in 2006. The following points better explain important factors of an Oligopoly market:

- The industry is dominated by few large firms. In UK, definition of an oligopoly is a 5 firms concentration ratio of more than 50%

- Strategic behavior/ interdependence among firms. An oligopoly based firm will be affected by how other firms set their price & output

- There are barriers to entry but less than monopoly

- Products sold are differentiated

There are different types of market structures that define businesses. Some of the known examples are pure competition structure, price discrimination, oligopsony, monopolistic competition, oligopoly, monopsony and pure monopoly. All these are used to define the different structures that govern businesses across industries. In this context, it can be said the Xbox operates within an Oligopoly structure. This is demonstrated by the fact that there are not many companies that manufacture gaming consoles and have distribution networks across the globe. The presence of fewer companies dealing in similar products and services makes the market structure of the Microsoft Corporation an oligopoly. This is also supported by the fact that, before Microsoft Corporation decides to make any changes to the design, features or pricing of the Xbox, it has to pause and consider the actions that will be taken by its competitors. This is in line with an oligopoly structure where an a company or an organization has to take into great consideration what its competitors may decide to do once it has made the effort of introducing a new product or service into the market (Moffat 2011).

In a monopoly marketing structure whereby the firm or company has nothing to fear before introducing a new product into the market arena for the single and mere fact that it is alone in the market. On the contrary, an organization or a company in an oligopoly market structure has to consider the repercussions of even minor changes being made to the product as this can easily lead to its competition getting an upper hand in the market. It may also consider collaborating to raise their profit margins through the use of obtaining a monopoly outcome.

In all these market structures, there are other factors that dictate how much a company may make from the sales of its products. These factors include the supply and demand of the product. Supply can be termed as the total distribution of products that can be brought to the market by the producers. On the other hand, demand can be defined as what buyers are able to purchase. Demand is usually dictated by price if all other factors are constantly held, whereby increasing the price reduces the quantity of products demanded. Supply on the other hand can increase if a product’s price rises making the suppliers give more for sale. This can be represented using demand and supply curves.

Price

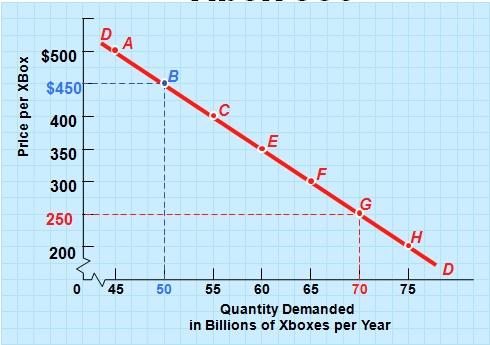

The law of demand states that when a demand of a certain commodity was low and everything else remained constant, the price of that commodity was high. When Microsoft’s Xbox 360 was first introduced into the market, the demand was a bit low due to the high price that was associated with the gadgets especially for the first few years. This is well explained by the fact that other products from competing companies like the Nintendo’s Wii and Sony’s PS3 were already in the market and they sold at relatively cheaper prices (Bishop 2006). Figure 3 represents the demand curve of Microsoft’s Xbox 360.

The X- axis represents the quantity demanded in billions of Xbox 360 in a year. The Y axis represents the price in dollars per Xbox 360 console. The graph shows that when the Xbox 360 was introduced in the market, it was selling at a high price and the quantity of gadgets ordered was low. At this time the popularity of the Xbox was at its lowest. Bearing in mind that the introduction of a new product to the market requires much money for promotion, and the fact that the product was not popular in the market, this meant that not many people would order for it and this made the prices shoot up.

Microsoft had also introduced the gadget at a higher price than the rest of the competitors so as to recover some of the money they used while manufacturing the consoles (Bishop 2006). But this high pricing initially reduced the demand of the product.

Figure 3: The demand curve of Xbox 360:

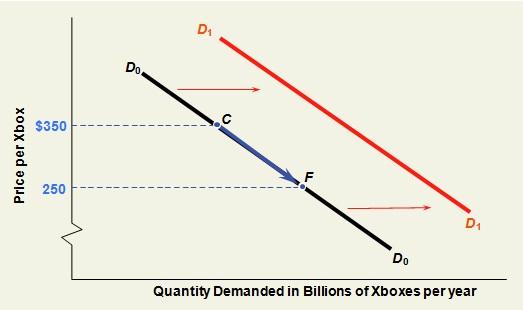

Figure 4 represents the shift in the demand curve post the price change:

Figure 4: Shift in the demand curve post the price change:

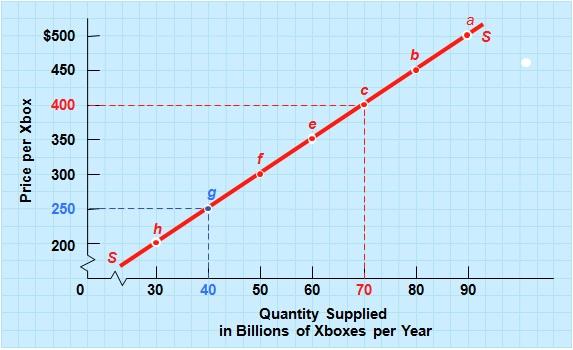

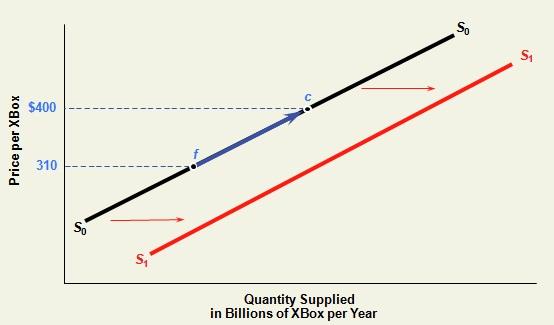

Figure 5 represents the supply curve of Microsoft’s Xbox 360. The X-axis represents the quantities of Xbox 360 supplied in billions while the Y-axis shows the price of the Xbox 360 per each box. From the graph, it is eminent that the more consoles were supplied, the higher the price was as shown for the Xbox 360.

Figure 5: The supply curve of Xbox 360:

Figure 6 represents the shift in the supply curve of the Xbox post the price change:

Figure 6: Shift in the supply curve of the Xbox post the price change:

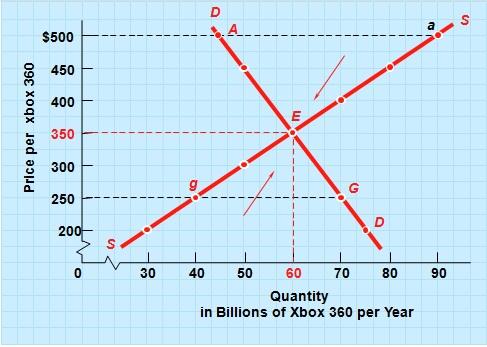

Equilibrium is the condition that arises when quantity supplied and quantity demanded are equal. At equilibrium, the tendency for price to change is nil. When quantity demanded exceeds quantity supplied at the current price, the condition is known as Shortage of Excess Demand. On the other hand, when quantity supplied exceeds quantity demanded at the current price, the condition is known as Surplus or Excess Supply.

Figure 7 represents the market equilibrium for the Xbox. The X-axis represents the Quantity of Xbox in billions while the Y-axis represents the Price per Xbox. The graph illustrates that, at the point of introduction, the Xbox 360 was heavily priced, at which point it had the lowest demand although the supply was high (Bishop, 2006). Eventually, as prices of the console were reduced, its demand increased while the manufacturers reduced the quantity supplied in order to control over production. According to the statistics, a price of US$ 350/- brings about the market equilibrium for the Xbox 360, wherein the demand and supply of the console are balanced.

Figure 7: Supply-Demand Market Equilibrium of Xbox 360:

Market Share

Microsoft has managed to penetrate the market and in the process acquire a large market share although it has been facing stiff competition from companies like Nintendo and Sony who have been pushing the marketing of their products Wii and Playstation, respectively, into untapped markets as well as existing ones (Justin 2010).

Figure 8 shows the rise and fall in global market share for the top three gaming consoles in the world. While Xbox 360 held a majority share in the year 2006 at 65%, it saw a sharp decline to 22% in 2007 and remained at that level till it witnesses a slight revival by the year 2010. In comparison, PS3 has seen a slow but steady growth from 2006 – 2010. On the other hand, Wii gained over 50% of the market share in 2007 and maintained it till a decline to 39% in 2010.

Figure 8: Games Consoles: Global Market Shares

In the year 2011, the worldwide sales figures of the three rivals stood at:

- Wii: 87.57 million as of 30th June 2011 (Nintendo, 2011)

- Xbox 360: 55 million as of 4th June 2011

- PS3: 50 million as of 31st March 2011 (Sony, 2011)

This growth in market share has been made possible by the strategy the Microsoft Corporation has devised of aggressively pricing their products. Another contributor to the growth in the market share is the popularity of the Halo games that has made the market competitive and expansive. The company has an average market share of 25 which mostly has been brought to existence by the wide variety of games on sale. These games have become very popular and some people are going to the extent of purchasing the Xbox 360 for the sole purpose of getting a chance to play the game and not because of the many advanced features that are accompanying the gadget. Although some of the Microsoft’s games may be expensive than those of the competitors, the trick lies in the fact that they (Microsoft) have a wider range of games to offer and therefore a loss is evaded by the great span offered to choose from. The popularity of the Xbox console and its gaming titles made it possible to penetrate the market share.

The HHI

The Herfindahl-Hirschman Index is used to assess and measure the concentration of competition in a market. It is usually derived by getting the squares of each of the competing organizations or firms in a particular market and then adding up the numbers that result. Taking the various market shares of each company, the HHI can be assessed. In the year 2009, the market shares for the three competing companies, namely; Sony, Microsoft and Nintendo had market shares of 26, 24 and 50 respectively in percentage. To get the HHI, these values are squared and then the summation of the result is attained as 262 + 242 + 502 = 3752. Therefore, from the summation of the squares of the market shares, we get the HHI which equals to 3752.

The Featured Indicator

An economic indicator is said to be a statistic that outlines how fairly the economy is behaving and is also used to predict the future trend in the economy. It can be used by companies to make knowledgeable business decisions by analyzing the market trends to predict future contingencies. An indicator can therefore fall under the category of any economic statistic like the GDP, the rate of unemployment or even the rate of inflation. Any of these indicators is important as it can be used to depict the pattern of economic growth and be used to gauge the future trend of the economy (Moffat 2011).

Getting the right information concerning any business is of paramount importance as many decisions dealing with the overall welfare of a company or a business institution are determined by the type of information that has been deciphered from collected data. Indications projecting either a positive or a negative growth would in most instances contribute to the decisions of altering the strategies of investing that had been formulated before.

The rate of unemployment is a good indicator that can be used to reveal how well or poor a particular country is doing. If too many people are losing their jobs, then chances would be the economy is not doing very well. This trend was particularly noted during the global economic recession of 2009, when companies around the world had to reduce their work force in order to cope with falling demands for products. Similarly, the rate of employment reveals whether a particular company or economy is doing well. From the consumer point of view, these indicators help organizations gauge the purchasing power of their target markets, enabling them to focus marketing efforts in areas where most sales may be expected. From an organizational perspective, these indicators reveal the financial standing of an organization to cope with fluctuating demand and supply ratios when compared to its competitors. Microsoft Corporation has been doing fairly well even at the time when the global economy is in turmoil due to the global recession mainly due to the popularity of the Xbox console which helped in raising revenue. Mindy Mount, the vice president and Chief Financial Officer of Microsoft’s Entertainment and Devices Division stated that the Xbox 360 stood gain from the economic recession than be impacted negatively. The main argument is that a bad economy makes every dollar more important, which means that Microsoft can push the Xbox 360, with its recent price cut, as the best value for money console on the market (Dumitrescu, 2008). According to the New York Times, Microsoft’s entertainment and devices, which includes the Xbox 360 video game console, Kinect game controller and the Zune music player, gained 60 percent to $1.94 billion. Kinect, a sensor that lets players interact with video games without having to hold a controller, did particularly well, selling 2.4 million units in the quarter. Customers bought 2.7 million Xbox 360s (New York Times, 2011). During a time when major corporations were cutting back jobs in order to stay afloat, the Xbox and its accessories enabled Microsoft to boost its revenues and minimize layoffs. The ability of the company seeking to employ additional people shows that it was making headways even in times of economic hardships and all this can be attributed to the popularity of Xbox 360.

The indicator can also be used to measure the rate of inflation of a nation or an organization so as to get the real picture of whether a nation’s economy or a company’s finance is doing well or not (The Economist 2007). A high rate in inflation means that the economy is not doing well and even the wages that the workers get may not be enough to cater for their needs as they may be required to pay more than expected for a particular good or service. High price of commodities can greatly reduce the purchasing power of consumers.

Different macroeconomic variables are projected differently. Some of the Macroeconomic Variables are Inflation rate, the rate of unemployment and the Gross Domestic Product. In this scenario, the variable that has been looked at is the Unemployment rate Macroeconomic Variable whose data is usually released every month as it usually is a thorny issue that needs constant monitoring and quick action to prevent it from becoming a calamity if not acted upon.

Figure 9 shows the number of employees that Microsoft Corporation employed for a period of over ten years which is a period to period annualized. These employees included both working in the domestic as well as global operations of the corporation.

Those in the domestic sector were working at the Microsoft Headquarters in the Redmond’s West Campus as well as other locations in the various districts. These workers ranged from the subordinates to the Information Technology professionals and others who dealt with the Microsoft Products and services either online or otherwise. The graph shows the steady growth of a company in the sense that, even at the Puget Sound facilities, there were new employees each year and this shows that the company could manage to pay for the salaries and wages of the employees and therefore it was doing well (Bishop 2006).

Achieving a continuous employment trend however small each year is quite an achievement and this shows that the company was making money from the sale of its products and it was feeling the need to seek the services of more so as to meet the demand in the market. In addition to the workers at Puget Sound, the company managed to employ other workers in the domestic sector. The employment trend has continued to manifest itself in the span of over ten years depicting an upward growth which is good for business (Bishop 2006).

Microsoft Corporation also expanded its overseas operations, recruiting workers and staff across all functions and departments in the process. By the year 2005, the company had employed quite a large number of workers resulting in a substantial gap between the domestic and international workforce ratios. This can be attributed to the need arising from customers to use the new products and this meant employing more people to meet the demand in the market and not to risk losing customers to the competitors (Bishop 2006).

Figure 10 represents the Estimated Market Share of the three companies presented in dollars. The horizontal axis in the graph represents a period of three years while the vertical axis represents the market share in percentages. The graph represents an overview of the competition in the market among the three companies bearing in mind that they deal in similar products and services.

In the year 2007, Nintendo Company amassed a larger portion of the market share than the other competitors mainly due to its pricing strategy whereby many of its products and services were going at a lower price than what was being offered by either Microsoft or Sony. Microsoft Corporation managed a market share of 28 percent in the same year finishing the year in the third position in terms of the market share. Although Xbox had a robust financial backing available mainly from Microsoft Corporation’s other offerings, it could not attain a large market share as the console was priced higher than its competitors. Needless to say, considering that features offered by all the competing consoles were more or less the same, price was the determining factor for consumer purchases.

In the year 2008, Nintendo led the other companies for the second time amassing a market share of 47 percent from a possible hundred. This was nearly half the total market share and this can be attributed to the pricing strategy that the company was using to market its Wii product. Nintendo Company ensured that their product was unique from competitors in its user friendliness, highly interactive interface and was made using state of the art technology including wireless controllers (Justin 2010). Such focus on quality and innovation greatly increased the popularity of Wii, leading to a greater market share for Nintendo. Sony was placed second in terms of the market share as it marketed its Playstation console on the basis of prices that were lower than that of the Xbox 360. Hence, it can be said that Xbox 360 lagged both, in features as well as pricing, which limited its market presence.

In the year 2009, Nintendo further increased its market by lowering the prices of Wii despite its obvious popularity among gamers. This ensured that Nintendo won over consumers who were buying competing consoles based on their prices. Wii sales were further aided by a favorable exchange rate that surprised the company when shipping out the software to other parts of the world. Hence, Nintendo was able to secure over 50% of the global market share. This was nearly two times the market share that had been amassed by the Xbox which could only manage about 24 percent of the market share (Justin 2010).

If this trend continues, Nintendo may soon amass over 60 percent of the market share especially if it continues to make unique gaming products that may attract a lot of enthusiasm and make them more popular than the ones offered by Playstation and Xbox 360. They also have an advantage as they have built up a great deal of goodwill amongst gamers by providing state of the art services and products for several consecutive years. Hence, consumers now perceive Nintendo to be better than its competitors, a trend that will be hard to break by the Xbox. The other companies will have to devise ways of dealing with such kind of competition if they want to remain relevant in the market.

Description of the behavior of the indicator

The behavior of the indicator for the last six months has been on an upward trend in most parts of the country which is mostly attributed to the rising cases of inflation and a weakened dollar. The rate of unemployment nationally is well beyond nine percent. But this is not the only problem here. There is an underlying problem especially in the Microsoft Corporation whereby, they are in need of thousands of Information Technology workers to fill some vacant positions so as to continue serving the community at large. This shows a situation where chances are available in the company but the stumbling block is the lack of qualified personnel to fill the vacant positions.

There is a chance that the market of the company’s products and services will rise irrespective of the general overview of the economy due to the unrelenting efforts of the company to introduce new products and services in the market. Microsoft has plans to continue opening other branches in the world due to the popularity the Xbox 360 is gaining. This will continue to heighten competition as top talent from the IT and gaming field will look for employment at what is considered to be the top software and IT company in the world. If the current trend is anything to go by, the next releases will push the company’s returns on investment higher.

It may be possible for the company to raise the market share a great deal as well as increasing the revenue if it uses the same tactics that it has been using for a while so as to minimize the gap in the market share usually dictated by the bigger company. Microsoft had used a technique earlier whereby it reduced the prices of its products and services and this paved way for a great magnitude of competition (Bishop 2006). By reducing the prices, it made sure that more people now were at liberty of purchasing the products, hence, increasing its market share in the gaming industry. The rising market share would in turn bring about greater returns and drive larger sale volumes. Further profits can be then expected from the sale of gaming titles as well as Xbox accessories.

Business cycle

A business cycle is a period during which a business, an industry or the entire economy expands and contracts. Business cycles can vary in intensity and duration. While economic booms and busts affect a broad spectrum of industries, every company can have its own business cycle. If one considers the GDP of a country as an indicator of economic standing, then the business or economic cycles can be explained as: a)Expansion: when the GDP is constantly increasing, b) Peak: the highest point of growth reached during a cycle, c) Contraction: when the GDP begins to fall due to various factors such as high inflation, and d) Trough: The lowest point reached by the GDP before its begins a recovery leading to expansion again (Moffat 2011). Figure 12 graphically depicts the typical business cycle:

The Xbox can be said to be in a state of contraction. The console’s popularity had witnessed an expansion as consumers became aware of its compatibility with various home entertainment systems and well as the massive fame of the Halo series of gaming titles. However, soon after Nintendo introduced the Wii with wireless controllers, its popularity sky-rocketed, triggering the contraction phase of Xbox’s business cycle.

Such lags in the indicator takes time to recover until the economy and unemployment rates stabilize and the purchasing power of consumers increases again. The progress of the Microsoft’s Xbox 360 does not necessarily mean that it may start employing new workers immediately as there has to be other factors to be considered like the overall return on investments.

The Federal Reserve has the mandate to come up with the policies concerning money at the national level. This is to make sure the prices remain stable, to maintain the set objectives of attaining employment to the maximum and maintaining rates of interests on a long term base and making sure that these rates are moderate (BGFRS 2002). Any change in the rates of interests on the short term base may ignite the interest rates on the long term base like the auto loans and the treasury notes, while a change in the rates of interest on the long term bases would change the prices of stock which in turn can affect household items. It is therefore necessary to maintain a balance in the short and long–term rates of interests.

My personal forecast of the report is that a drop in the rates of long term interests may encourage people to invest in the hope that profits will increase in the future and hence increasing the prices of equity. This decrease in interest rates may lead to a low value of exchange for the dollar which may, in turn, lead to low costs of financing making people desire to invest due to low costs of financing projects hoping to reap later in the future when prices may be high.

References

Board of Governors of the Federal Reserve System. (2002). The Federal Reserve System Purposes and Functions. Washington, D.C.: Books for Business.

Bishop T. (2006, July 26). Microsoft employment soars. Seattle pi. Retrieved from http://blog.seattlepi.com/microsoft/2006/07/26/microsoft-employment-soars/

The Economist. (2007). Guide to economic indicators: making sense of economics. New York, NY: Bloomberg Press.

Voets, A. (2010). How to Reduce Costs and Increase Market Share through Rationalization of the Design Process of Products: Rationalization, Design Process. Norderstedt Germany: GRIN Verlag.

Moffat, M. (2011, July 29). A Beginner’s Guide to Economic Indicators. Retrieved from http://economics.about.com/cs/businesscycles/a/economic_ind.html

Justin. (2010, Jan 18). Nintendo, Sony and Microsoft estimated revenue and US marketshare. Retrieved from http://gamerinvestments.com/video-game-stocks/index.php/2010/01/18/nintendo-sony-and-microsoft-estimated-revenue-and-us-marketshare/

Sony. (2011, Mar 15). Playstation 3 Sales Reach 50 million units worldwide. Retrieved from http://www.scei.co.jp/corporate/release/110415_e.html

Nintendo. (2011, Jul 28). Consolidated Sales Transition by Region. Retrieved from http://en.wikipedia.org/wiki/Console_wars#Worldwide_sales_figures_6

Hoovers. (2011, Aug 2). Microsoft Corporation. Retrieved From http://www.hoovers.com/company/Microsoft_Corporation/rcrtif-1.html

Dumitrescu, A. (2008, Nov 18) Xbox 360 is Recession-Proof. Retrieved from “http://news.softpedia.com/news/Xbox-360-Is-Recession-Proof-98041.shtml

New York Times (2011, Apr 28). Xbox, Kinect sales power Microsoft earnings. Retrieved from http://www.startribune.com/business/120928484.html